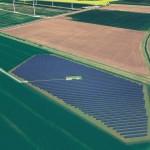

Rural co-op bids to buy 5 MW solar farm in Wiltshire

One of the largest solar PV arrays in the country is that situated on a site between Swindon and Oxford known as Westmill Solar. The array was built a year ago to profit from Feed-in Tariffs which were then available to large installations, now the farmer who owns the land is aiming to buy the farm back for community ownership.

Westmill solar consists of 21,000 panels and it will become the largest community owned solar farm in the world if farmer Adam Twine's recent share issue to buy back the array is successful. Already the new venture has announced that it has the £2.5 million necessary to take the project on to the next stage, it needs another £16.5 million to buy the PV farm outright. A quarter of this (between £2.5 million and £4 million) will hopefully come from individual investors with the remainder being sought from institutional bond holders with an interest rate of 3.5% above the retail price inflation (RPI).

Westmill solar consists of 21,000 panels and it will become the largest community owned solar farm in the world if farmer Adam Twine's recent share issue to buy back the array is successful. Already the new venture has announced that it has the £2.5 million necessary to take the project on to the next stage, it needs another £16.5 million to buy the PV farm outright. A quarter of this (between £2.5 million and £4 million) will hopefully come from individual investors with the remainder being sought from institutional bond holders with an interest rate of 3.5% above the retail price inflation (RPI).

The innovative financing scheme should create a model for other investors funding similar projects to follow given that the project is focused on providing decent returns to local people and small investors. For a start off, the project will buy back 5% of its shares each year from year 2 to year 10 as a tax efficient means of returning capital to shareholders, the dividends will rise accordingly as the bond holders are paid. By year 24, when Feed-in Tariffs have ceased, the returns should be over 50% a year on shareholder capital. Because they are index-linked they will be very reliable, something that is increased given that PV output is generally more stable than wind. This means that the business will be able to maintain itself with only a thin veneer of shareholder capital, thereby enhancing percentage returns on investment.

Feed-in Tariffs and exported electricity will provide a gross income of around £1.7 million per year, rising with inflation. Interest over the first year will be about £0.8 million. Running costs of about £200,000 will leave £0.7 million to begin paying back the debt while providing a small return to investors. An increasing fraction of the total income will be diverted to shareholders as the bond holders are paid back. If however the investment bank fails to secure bond finance the sale of the array will not proceed and the private investor money will be returned minus 5% in order to pay for the costs of organising the offer in the first place.

Another main risk is the possibility of very high levels of inflation in the near future. This means that until the company has paid back a substantial fraction of the £12.5 million to £14 million debt to bondholders, it will be vulnerable to high inflation rates. If the poor summers of recent years continue, low levels of sunshine might also present a serious risk. Nevertheless, communities around the UK could in theory copy this scheme, particularly given the fall in costs of solar PV equipment which means that large projects are viable again. A similar array might be able to be constructed for less than £7 million and there are already a number of prospective solar farm projects embedded in the planning process, particularly in the south west of England.

Find local, MSC certified Solar Installers

Start your quote

Find local, MSC certified Solar Installers